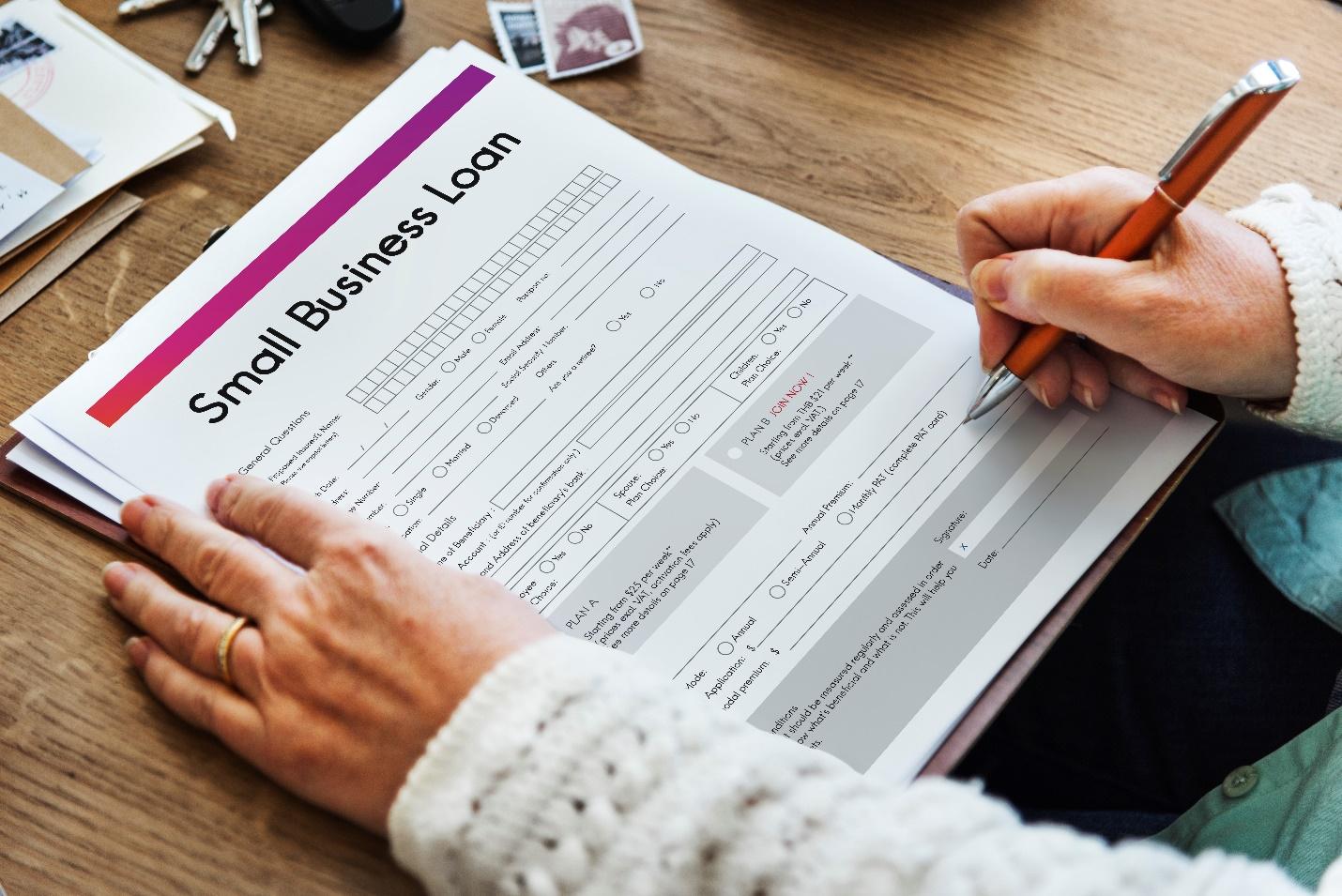

Understanding Small Business Loans

Small business loans support business owners when they are establishing, growing, or managing their enterprises. The U.S. Small Business Administration (SBA) estimates that there are 32.5 million small enterprises nationwide, making up a sizable portion of the American economy. Even while each one is different; they all have one thing in common: they all require business funding.

Funding for small enterprises that are underfunded

Many funding options are available for historically underprivileged firms, including those run by women, veterans, Black, Asian, Latino, and Native American business owners.

Financing for women’s businesses

Women who own their own enterprises are eligible to apply for grants or debt financing. The growth of women-owned firms has outpaced that of all American businesses in recent years. However, when women are given business loans, the average yearly loan amount is around 33% smaller than it is for males.

Financing for minorities’ businesses

Business grants and loans are options for capital for business entrepreneurs of color. Those who live in historically underrepresented communities confront more funding-related entrepreneurial challenges than their peers. Funds are allocated by institutions and lenders all around the United States to help minority-owned enterprises.

Financing for veterans’ businesses

Small business owners with a history of military service also have access to a variety of services and funding choices. Many veterans find it difficult to apply their military experience to civilian professions after leaving the service, so some opt to launch their own businesses instead. Veterans’ business loans are one of the secrets to success.

Obtaining a small business loan

Depending on the kind of business loan you’re looking for, the application process for small business loans varies. Equipment financing normally requires less paperwork than a business line of credit, while short-term loans typically have less paperwork than long-term loans. To increase your chances of approval, it’s still a good idea to have the following documents on hand in case they are required:

Checklist for applications for small business loans

Once you’ve decided that your business is capable of handling a loan, you should start gathering the appropriate paperwork for your loan application. Although the specific paperwork varies depending on the finance partner, it almost certainly consists of the following:

- Personal and company tax returns spanning two to three years

- most recent profit and loss report

- historical bank statements

- contemporary balance sheet

- legal documents pertaining to ownership

- details about outstanding debt

- business permit (if applicable)

- business strategy

REMOVE THESE USUAL SMALL BUSINESS LOAN MISCONCEPTIONS

Applicants that are rejected frequently commit the error of submitting financial documentation and company plans that are insufficient or poorly thought out. When requesting a small businessloan, it’s critical to gather as much prepared information as you can.

SHUT OFF YOUR LOAN

After approval, the closing procedure is going over the paperwork that will decide the conditions of the loan you’ve chosen. Your interest rate and payback plan will be set down in a legally enforceable agreement called a business loan contract. Make sure you comprehend what the lender is asking of you and how these conditions will affect the financial viability of your company. All of the terms of the contract, including what happens if you make late payments or default, are accepted once you have signed.

What do small business lenders look for?

Lenders for small businesses are interested in learning how stable your business and credit history are. In order to assess your risk as a borrower, they will consider a number of different debt, asset, credit, and operational criteria.

TIME IN BUSINESS

A business that has been operating for a while is typically more stable than a startup. This is crucial for lenders since a company with steady sales over the previous two years is a more appealing borrower than one with erratic revenue over the previous six months.

CREDIT SCORE

A startup is typically less stable than a company that has been operating for a few years. This is important for lenders since a company that has a track record of consistent revenue over the past two years is a more appealing borrower than one with erratic income over the previous six months.

CASH FLOW

A cash-flow projection outlines when money is brought in, when it is spent and how much is left over. Lenders prefer it when borrowers.

COLLATERAL

If you are unable to make payments, creditors may legally seize collateral, such as office space, machinery, and accounts receivable. Some business owners opt to use their personal assets, such as their homes, as security for a loan for their company.

DEBT-TO-EQUITY RATIO

The debt-to-equity ratio of your business is the ratio of debt to shareholders’ equity. Based on the debt you are already paying; this measure helps a lender determine how likely you are to be able to pay off new debt.

WORKING CAPITAL

Your company’s working capital is the cash you have on hand to support regular business activities. By deducting current assets that can be converted into cash from the business’s debt obligations due within a year, you can determine your working capital.